Overview

Contributing to your tax-advantaged 401(k) now can help you prepare for retirement and “what-ifs” down the road. The Lineage plan is easy to use because your savings come out of your pay automatically, plus, Lineage contributes to your account to help your savings grow faster.

Key advantages

Company contributions

Lineage contributes to your account to help your savings grow faster and provides immediate vesting of all employer-matching contributions.

Current tax savings

You’ll pay less in income taxes when you make pre-tax contributions from your paycheck.

Tax-deferred investment growth

Pre-tax contributions let your money grow without being taxed until you withdraw it.

Wide range of investment options

Choose your investments or follow Vanguard’s expert recommendations, including Target Retirement Funds.

Eligibility & Enrollment

You will become eligible to contribute to the 401(k) on the first of the month following 30 days of continued employment. You can receive the Lineage match on the first of the month after working at Lineage for six months.

Once you become eligible, you’ll be contacted by Vanguard directly via mail to set up your account.

- Existing team members: If you’ve been with Lineage over 30 days and haven’t enrolled in the 401(k) plan, contact Vanguard at 1-800-523-1188, Monday‑Friday 7:30 AM to 8:00 PM CT to get started.

You may start, stop, or change your contribution rate and investment elections at any time by visiting the Vanguard website or calling 1-800-523-1188. Open Enrollment is a great time to review your current contributions and beneficiaries and make changes as needed.

How to initiate a rollover to the Lineage 401(k) with Vanguard

Are you looking to rollover your existing 401(k) savings from a prior carrier to Vanguard? Click here for step-by-step instructions on how to complete the rollover process.

Vanguard participant services is available to assist with the rollover process. Call 1-800-523-1188 between 8:30am and 9:00pm if you have any questions.

Your Contributions

Once your account is created, you can choose how much of your paycheck to set aside. You may contribute between 0% and 75% of your eligible pay to your plan account, up to annual IRS limits.

2025 contribution limits

| 401(k) account holders | 2025 contribution limits |

|---|---|

| Those under 50 | $24,500 |

| Those 50 and over this year | $32,500 (which includes an additional $8,000 in catch-up contributions) |

| Those 60 through 63 this year | $34,750 (which includes an additional $11,250 in catch-up contributions) |

These limits include your pre-tax contributions, post-tax contributions or a combination of both.

Pre-tax vs. post-tax: What’s the difference?

The Lineage 401(k) Plan gives you the flexibility to save for retirement with pre-tax contributions, post-tax contributions or both.

- With pre-tax contributions – the money goes into your account before taxes are deducted, so you keep more of your take-home pay.

- With post-tax contributions – the money goes into your account after taxes are withheld, but both your contributions and any associated earnings can be withdrawn tax-free in retirement.*

* Generally, withdrawals before 59 incur penalties, but exceptions may apply. Contact Vanguard to understand your options and potential consequences.

Catch up!

If you’ll be 50 or older this year, take advantage of the opportunity to contribute up to an additional $8,000 in catch-up contributions.

If you’ll be 60-63 this year, you are eligible to contribute even more in catch-up contributions, up to an additional $11,250.

Investment Options

You can choose your own investment options or pick from Vanguard’s recommended funds, including Target Retirement funds, to give you the best mix of investments to maximize your earnings before retirement.

Company Contributions

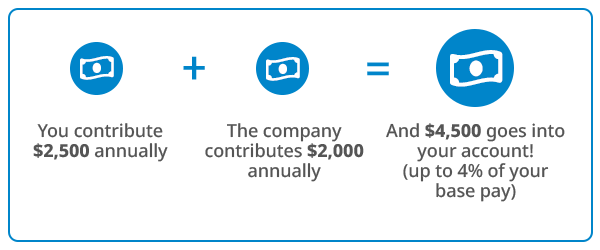

Lineage helps you reach your retirement goals faster by making matching contributions to your account.

- Lineage matches 100% of your pre-tax and post-tax contributions to the plan, up to 3% of your eligible pay*

- Lineage matches 50% of your pre-tax and post-tax contributions to the plan for the next 2% of your eligible pay*

This means that if you put at least 5% of your base pay towards your retirement savings, Lineage will contribute an amount equal to another 4% of your pay.

* Eligible pay includes your base salary, not including any bonus or commissions.

Here’s how the company match works:

For example, if you earn $50,000 per year and wish to receive the maximum company match:

Don’t leave free money on the table!

Contribute at least 5% to take full advantage of the maximum match from Lineage — otherwise, you’re leaving free money on the table. Log in to your Vanguard account to increase your contribution rate.

Remember, Lineage matches your contributions with each paycheck. To maximize the match, be sure to make a contribution every paycheck and avoid reaching the maximum limit too early in the year. Spread out your contributions evenly throughout the year to make the most of this valuable benefit.

Vesting

Vesting is another way of saying, “how much of the money is yours to keep if you leave the company.”

Unlike many companies, Lineage provides immediate vesting of all employer matching contributions. You are 100% vested in your own contributions and the company’s contributions to your account, including any investment gains and losses on these contributions. This means you own all the money in your account right away and if you leave the company, you will take both your and Lineage’s contributions to your account when you go.

Name a Beneficiary

To ensure your family’s financial security, it’s important to designate a beneficiary and keep your beneficiary information up to date with Vanguard. Regularly review and update beneficiaries, especially after major life events.

In the event of your death, your 401(k) balance will go to your beneficiaries. Naming your beneficiary ensures the money goes to the right person. You can designate more than one beneficiary or name a trust, charity or estate to receive the benefit.

To add or change your beneficiary: Vanguard beneficiaries are not housed in the Workday system. To access your current beneficiary details or make a change, log on to your personal Vanguard account.

Withdrawals and Loans

The money in your account is a long-term investment to help you prepare for your financial needs in retirement. However, under certain circumstances, you may be able to access money from your account before reaching retirement age. For more information, visit the Vanguard website or call 1-800-523-1188.

Think before you act

- If you’re considering taking a withdrawal or loan from your plan account, keep in mind that taking money from your account now may lead to a smaller savings balance when you retire

- Not only are you taking money away from your retirement savings, but the burden of repaying the loan may make it harder to get back on track

- If you take a loan, you’ll also lose more money to taxes because the interest payments on your loan are made with money that has already been taxed, and it will be taxed again when withdrawn from your account

- If you withdraw pre-tax money from your plan account, in addition to paying current taxes on the money, you may have to pay an additional 10% penalty tax if you are younger than age 59½ (or age 55 if you have retired or left the company)

Tools & Resources

Whether you’re new to investing or a seasoned pro, Vanguard offers complementary advisory services and resources to help you understand what you need for a successful retirement*.

* Before investing, carefully consider the funds’ or investment options’ objectives, risks, charges and expenses. Call 1-800-523-1188 for a prospectus and, if available, a summary prospectus, or an offering circular containing this and other information. Please read them carefully. Investing involves risk, including the risk of loss.

Need help making the best decisions for your retirement plan?

Vanguard, in partnership with Edelman Financial Engines, offers two ways to get the help you need.

- With the Personal Online Advisor, you can manage your plan investments while receiving expert guidance tailored to your needs at no cost to you.

- If you prefer a hands-off approach, the Managed Account Program allows investment professionals to oversee and manage your investments for you (fees apply*)

To access these offerings, log on to your account, and select “Get Advice.” If you need to register for access, go to Vanguard, and select register for online access. You will need your plan number to register which can be found on your account statement.

* Fees apply and will not be greater than 0.40% of your account balance (subject to a $60.00 annual minimum fee).

Expand your knowledge

Join a monthly Virtual Education Series by Vanguard to expand your knowledge on:

- Retirement

- Protecting your future

- Saving for college

- Investing

- And more!

Visit virtualeducationseries.events.vanguard.com to watch online webinars offered live and on‑demand*.

* Webinars are available for 60 days after recording.

Submitting a Distribution Due to Death

If your loved one passes away and you are their beneficiary, be sure to complete the process to inherit their account to ensure their 401(k) balance goes to you. Log in to your Vanguard account to begin the process.

How it works:

For more information on this process, please visit the Vanguard Inheritance Overview website. You can also reach out to the Lineage Benefits Department at benefits@onelineage.com for more information on filing a distribution due to death or contact Vanguard directly at 1-800-523-1188 to get the forms needed to process a distribution.